Trend lines are one of the most used tools by Forex traders, it is critical to comprehend their operation. Trend lines are lines used in forex trading to connect two or more significant price points on a price chart and show the strength and direction of a trend. During an uptrend and a downtrend, the higher lows and lower highs on a price chart are connected to form trendlines. The reversal of the current trend or its probable continuation could be indicated by the breaking of a trend line. Investors typically use trend lines in conjunction with other technical analysis tools and indicators to aid in their decision-making.

What Is a Trendline?

Trading professionals use trendlines—distinctive lines—on charts to connect a series of prices or show which data points suit a trend the best. The trader can then make use of the resulting line to obtain a clear picture of the possible direction of a stock’s value movement.

Trendlines provide a visual representation of support and resistance for any time span. During times of price contraction, they also define patterns and display the direction and speed of the price.

In this post, we’ll cover three different trend line patterns and go over how to apply them to forex line trading

- Uptrend Lines

- Downtrend Lines

- Sideways Trend Lines

How to use tradelines in forex line trading

A trendline cannot be constructed unless a trend in the price movement of a pair has been identified. A downward or upward trend may be present. You can draw a trendline by following method:

Analyze the price movement to ascertain the trend’s direction:

If an item or investment is in an uptrend or a downturn, the price movement will show you this. A downtrend differs from an uptrend in that a succession of lower highs than lows characterizes it, as opposed to the former, which is the case for an uptrend.

Linking chart points:

If you want to locate two or more swing points, look for those that connect the trend. When a price high or low is followed by a shift in the trend’s direction, this is referred to as a swing point. Connect the swing lows and highs to indicate an uptrend or a downtrend, respectively.

Draw the line:

After determining the swing locations, draw a straight line connecting them. forex line trading represents the trendline. The line must come into contact with two swing points in order to be considered legitimate.

Line adjustment:

The trendline may occasionally need to be modified to account for changes in price. Adjust the line as necessary to touch as many swing points as possible without crossing the price movement…

However, after being drawn, Trendlines frequently need to be adjusted. Prices rarely change over time in a regular manner. As a result, if the trend accelerates or decelerates, the trendline must be adjusted.

Remember that just because you move a trendline doesn’t mean the trend has altered. Higher highs and lower lows define an uptrend, and as long as those continue to occur, the trend will continue to be up. You might discover that within a single uptrend, your trendlines need to be adjusted numerous times.

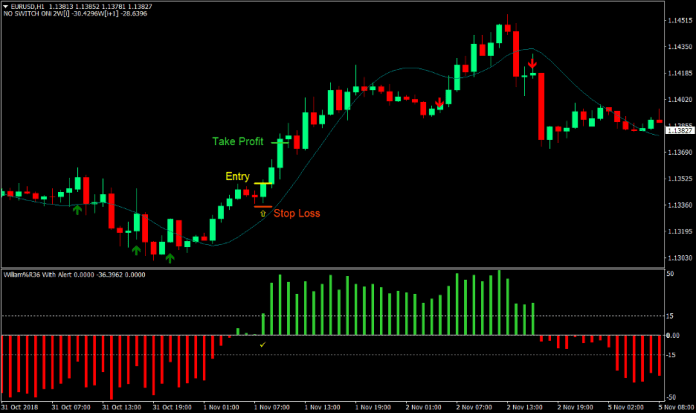

Confirm the trend:

After drawing the trendline, you can use additional indicators, like moving averages, candlestick patterns, and the RSI, to assist you in determining the trend’s direction.

Utilizing Several Trendlines

Normally, more than one trendline would be in effect. You can draw a variety of trendlines at any given time, each one depicting the price change over different time periods. New traders may find it helpful to draw trendlines wherever possible and on several time frames to help them identify larger trends, smaller trends, and corrections within those smaller trends.

Opportunities to purchase or go long during an upswing may arise when a recent decline crosses the general ascending trendline. Selling or shorting chances may arise during a downturn when a recent rally crosses the overall declining trendline..

Conclusion

In order to predict whether a currency pair will keep rising or falling, technical analysts employ lines drawn on the charts. A trader utilizes two parallel, upward-sloping lines, sometimes known as “trading bands,” to try to assess whether a currency is in an uptrend. Indicating that the forex line trading is now rising and remains a solid investment option, the price of the currency should rise above this line.