Welcoming you to the exciting world of currency trading, a worldwide market where billions are earned and lost alongside the soaring and collapse of currencies. As we explore the complicated world of forex in this primer for newcomers, we’ll simplify its complexity and equip you with the information you need to successfully negotiate the foreign exchange market.

This overview will give you the essential knowledge and tactics to begin your forex exchange trading experience, whether you’re trying to spread your financial portfolio or take on a brand-new, exciting project. We’ll give you the skills you require to confidently begin this thrilling financial excitement, from comprehending different currencies to perfecting managing risks.

Forex Trading: What Is It?

Forex exchange trading is the practice of acquiring and transferring commodities in the foreign currency arena. The foreign exchange (FX) marketplace is the biggest and most rapidly growing trading system in the globe, with an average daily transaction of over $6 trillion. The forex market operates around the clock, seven days a week throughout an international network of financial firms, banking enterprises, governments, and private traders, in contrast to stock markets, which have centralized exchanges.

Profit from changes in the conversion prices between each currency is the basic tenet of forex trading. Traders make predictions about how one currency will perform about another. For instance, you might purchase euros with dollars if you anticipate that the value of the euro relative to the dollar will increase. If your forecast is accurate, you will benefit when you offer those euros out for more money.

The Basics of Currency Pairs

In forex trading, you trade currency pairs. A currency rate pair consists of two currencies: the base currency and the quote currency. The base currency appears foremost in the pair, followed by the quote currency. For instance, the euro is the fundamental currency and the U.S. dollar is the quoted value in the EUR/USD pair.

Three distinct categories can be used to classify currency pairs:

Major Pairs: These are the most traded pairs and include currencies from the world’s largest economies, such as EUR/USD, GBP/USD, and USD/JPY.

Minor Pairs: These pairs don’t include the U.S. dollar, like EUR/GBP or AUD/JPY.

Exotic Pairs: Exotic pairs involve a major currency paired with a currency from a smaller or emerging economy. Examples include USD/TRY or EUR/THB.

How Forex Exchange Trading Works

Leverage: Forex trading allows you to trade on margin, meaning you can control a larger position size than your initial investment. Be cautious when utilizing leverage because it might increase profits yet increase the danger of losses.

Market Orders and Pending Orders: You can execute trades either at the current market price (market orders) or at a specific price level (pending orders). While waiting orders are carried out when the marketplace hits the desired price, market requests are carried out immediately.

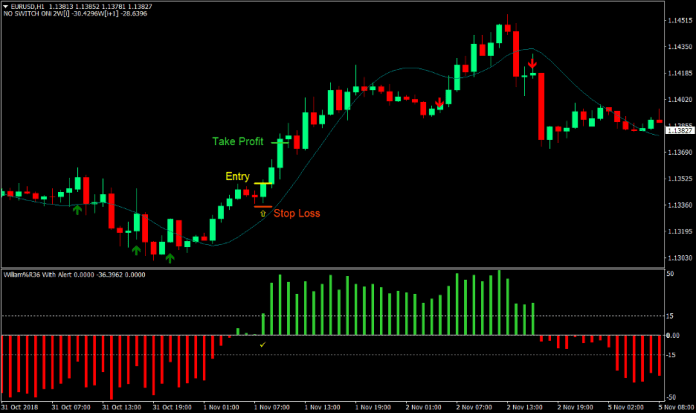

Risk Management: Managing risk is crucial in forex trading. You should set stop-loss and take-profit orders to limit potential losses and secure profits. Additionally, it’s essential to determine the size of each trade based on your risk tolerance and account size.

Analysis: Traders use two primary types of analysis: technical and fundamental. Technical analysis involves studying charts and using various indicators to make trading decisions. Fundamental analysis considers economic and geopolitical factors that can influence exchange rates.

Trading Techniques: A variety of trading techniques exist, such as day trading, trading swings, and investing for the long haul. Adopt an approach that fits your interests and goals because each has an individual risk profile along with a time frame.

Getting Started in Forex Trading

Now that you know the basics of forex exchange trading, let’s look into how you can begin your career as a forex dealer.

Education: Before you dive into the markets, invest time in educating yourself. There are numerous online resources, books, courses, and demo accounts available to help you grasp the fundamentals and develop trading skills.

Pick a Trusted Broker: Choosing the best broker is an important choice. Choose an exchange with solid credibility, aggressive spreads, a simple trading interface, and dependable customer service. Ensure they are regulated by a relevant financial authority to protect your funds.

Test your skills with a trial account: Many brokers provide trial accounts that let you trade with fictitious funds. This is an excellent way to get a feel for the platform, test your strategies, and gain experience without risking real capital.

Create an Investing Plan: It’s important to have a clear trading strategy. It should outline your trading goals, risk tolerance, preferred trading hours, and strategies. Keep to the objective and refrain from making rash decisions.

Conclusion

For those ready to put in the time and energy to learn, Foreign exchange trading provides a world of potential. Although it can be intimidating for novices, you can negotiate forex markets and possibly make a good living with the correct training, discipline, and practice. Keep in mind that becoming a good trader is a process rather than a goal. It’s a lifelong process of schooling, and even seasoned traders have difficulties and failures.