For traders who wish to thrive in the forex market, charting software is a need. With the aid of the charts, traders may spot trends, patterns, and prospective trading opportunities. For newbies, though, it might be overwhelming to interpret forex trading charts. We will cover all the information you require to master forex trading charts in this comprehensive book.

Traders can use a variety of approaches as part of their forex trading strategy to get an advantage and increase profits. Forex line trading is one strategy that has grown in popularity recently.

Types of Forex Trading Charts

There are three basic categories of forex trading charts:

- The simplest sort of chart is a line chart, which is made by joining closing prices over a specified period of time. Line charts are helpful for seeing long-term patterns, but they do not offer comprehensive details on price changes.

- Contrarily, bar charts show the high, low, opening, and closing prices over a certain period. When determining price swings and support and resistance levels, bar charts are helpful.

- The most common style of forex trading chart is the candlestick chart. They are helpful for spotting trends, patterns, and prospective trading opportunities since they give more specific information on price changes. Candlestick charts use a graphic depiction that looks like a candlestick to show the opening, closing, high, and low values.

Understanding Forex Line Trading

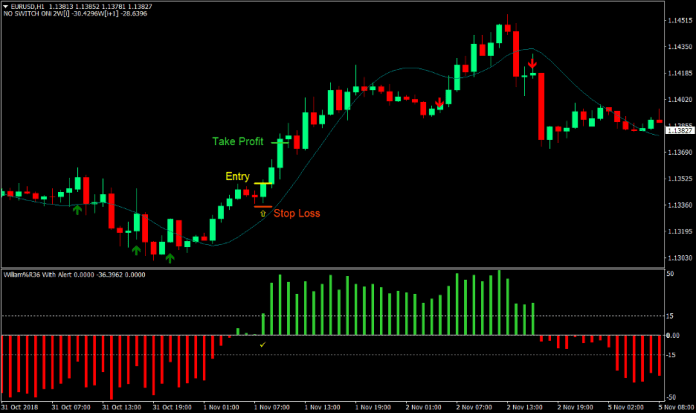

A key strategy in the realm of foreign currency trading is forex line trading, commonly referred to as trendline trading. To locate and assess trends in the foreign exchange rate market, lines are drawn on a price chart. A sequence of highs or lows is connected by these lines, thus forming support and resistance levels that traders can utilize to make well-informed choices.

Identifying the market trend and probable entry and exit locations for trades is the main objective of Forex line trading. A trendline drawn linking a string of higher lows denotes an uptrend, while one drawn connecting a string of lower highs denotes a downward trend. These lines are used by traders to assess the strength of the trend and forecast future price changes.

Traders can easily visualize market dynamics and respond quickly to shifting conditions by using Forex line trading. They can pinpoint pivotal levels where price action might change, which improves their ability to control risk. Furthermore, trendline trading can be combined with other technical indicators to strengthen overall tactics for trading and confirm signals.

It is important to recognize that Forex online trading is not risk-free and calls for good risk management techniques. Trading professionals should be aware that trends can shift quickly and that depending entirely on trendlines could result in dangers. Successful Forex line trading requires a thorough understanding of market analysis as well as effective risk management.

Implementing Forex Line Trading: Essential Tips

Find Important Market Trends:

Start by identifying the main market trend. You may examine the market’s overall direction by using greater time frames, such as daily or weekly charts, which will make it much easier to generate accurate and dependable trend lines.

Trend line breakouts:

Must be confirmed before beginning trades based on them, even though trend lines offer priceless insights. Before taking any action, watch for confirmation indications like candlestick patterns, price movement, or technical indicators to confirm any break in trendlines.

Utilizing several time frame analyses can provide a much larger perspective of the market. Lower time frames provide information about entry and exit locations, whereas higher time frames should be able to spot major patterns.

Practice Patience and discipline are necessary for successful Forex line trading. Avert being persuaded to enter or exit deals too quickly. Maintain your trading strategy and pay close attention to any trend line signs.

Common Challenges in Forex Line Trading

False Breakouts: False breakouts that occur on trend lines occasionally might result in losses. To lessen this risk, wait for confirmation signs or use extra technical analysis techniques to verify a breakout and hold off on taking actions based on it until they arrive..

Drawing Trend Lines Subjectively: Since trend line drawing is subjective, it is possible for traders to draw them inconsistently. As a result, it is critical to establish and follow defined criteria in order to ensure analytical consistency.

Wrap up

An unbiased and organized approach to researching and trading the Forex market is offered by forex line Trading. Trading professionals can enhance their ability to make decisions and raise their likelihood of success by becoming experts in drawing and interpreting trend lines.

It will help you hone your skills so that you may fully take advantage of the chances presented by forex trading. It involves practice, patience, and discipline, just like any other trading technique