Having a grasp on real-time market data and analysis is essential for making wise trading decisions in today’s frenetic market conditions. In the competitive foreign exchange rate (Forex) market, traders and financial institutions depend on precise and current information to stay ahead. Fortunately, the development of Forex APIs has fundamentally changed how market data is accessible and analyzed.

In this piece, we’ll look at the advantages of employing a Forex API for real-time market data and analysis. As well as how it may help traders and businesses make wiser trading decisions.

Forex API: What Is It?

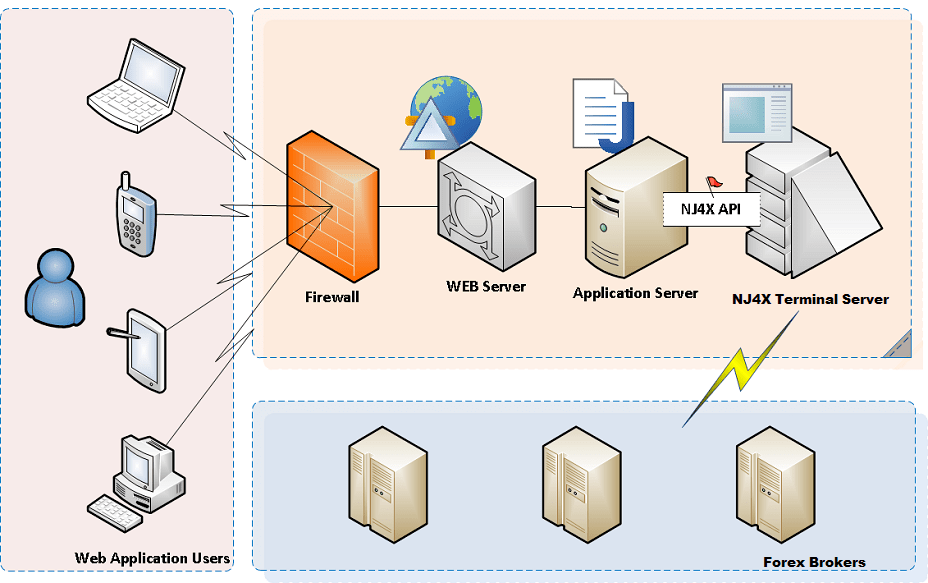

A software interface called a Forex API, also referred to as a Foreign Exchange Application Programming Interface. It enables programmers to access current and past information about the foreign currency market. Also it offers a uniform method for retrieving data on exchange rates, currency pairs, previous prices, market trends, and other pertinent data items.

Moreover, forex APIs give traders and financial organizations the tools they need to access precise and fast market data. While improving their capacity for decision-making and enabling more effective trading procedures.

Employing Forex API for Real-Time Market Data and Analysis – 6 Benefits That Every Trader Should Know!

· Real-Time Market Data

A forex API offers traders real-time market data, such as currency pairs, foreign exchange rates, and other essential trading details. Using this real-time data stream, traders may constantly monitor the market and take advantage of lucrative trading possibilities as they present themselves.

Traders may obtain precise and dependable data instantly by incorporating a free Forex API into their trading systems, which enables them to keep on top of market moves and respond quickly to market shifts.

· Enhanced Market Analysis

Trading professionals can do comprehensive market analysis by using a Forex API. Also, the trading decisions can be made more intelligently by utilizing historical data and real-time updates to spot trends, patterns, and correlations.

As well as, traders can conduct technical evaluations and create reliable trading strategies by gaining possession of historical price data for a variety of currency pairs through the integration of an FX Historical Price API. This historical data can be integrated with real-time market data to improve forecasting and get a deeper understanding of market dynamics.

· Seamless Integration with Trading Systems

Forex APIs make it simple to integrate with platforms and systems for trading, giving users an effortless trading procedure. The adaptability and interoperability of Forex APIs allow traders to quickly access real-time market data and complete deals. Whether they are connecting to well-known trading platforms or creating trading applications.

Using APIs, traders can automate trading techniques, deploy algorithmic trading, and develop custom trading tools that are suited to their unique needs.

· Customizable Analysis

Using a Forex API gives you the power to tailor your analysis to meet your unique trading needs. Leverage the API’s versatility to enhance your trading methods with technical analysis tools, indicators, and algorithms.

As well as, this degree of personalization enables a greater comprehension of currency trends and patterns, empowering you to take more sensible decisions. Whether you choose straightforward moving averages or intricate statistical models. A Forex API allows you the flexibility to customize your analysis and fit it to your trading approach.

So, if you’re a trader looking for a reliable company to provide customized trading solutions to you then Elk Layer is your go-to partner! Elk Layer is aware that every trader has particular needs and preferences. They provide flexible Forex API solutions designed to satisfy certain requirements. Traders can customize the API parameters, data formats, and functionalities to align with their trading strategies and objectives.

· Streamlined Exchange Rate Conversion

It’s critical to have accurate and recent exchange rates for businesses that engage in global commerce. Businesses may get real-time exchange rates via a trustworthy Exchange Rate API connected to their systems, making currency conversion simple.

This guarantees that companies may handle currency risk, precisely evaluate costs, and make wise financial decisions. Moreover, businesses may conserve time and resources while assuring consistency in their financial operations by automating exchange rate adjustments with a Forex API.

· Scalability and Integration

The seamless integration and scalability of a Forex API are two of its main benefits. The API is simple to integrate with your current trading systems, platforms, and applications. Enabling a seamless data flow and improved functionality. A Forex API may also easily scale to handle larger data quantities and trading activity as your organization expands and demands rise.

Moreover, this guarantees that no matter the size or complexity of your organization. Your trading operations will continue to run smoothly and efficiently.

Conclusion

A Forex API offers real-time market data and analysis with multiple benefits for traders and organizations in Forex. With real-time market data to integration with trading systems, traders gain a competitive edge and improve their trading outcomes.

Moreover, a Forex API equips traders with the knowledge and insights necessary to make wise and lucrative trading decisions. Whether it’s keeping up with real-time market rates or doing thorough market analysis. Make use of the strength of Forex APIs to improve your trading methods.